Since its inception, RR Financial Consultants is offering customer

focused financial services and range of investment solutions to its customers. We

closely work with our clients to understand and meet their financial and investment

objectives. RR Financial Consultants facilitiates its customers to trade in all

the market segments. They can also have the advantage of having Research based information

and all Advisory Services for Insurance, Mutual Funds, IPO’s, Online Trading,

Portfolio Management and Wealth Managment also.

INVESTMENT BANKING

RR offers full range of quality financial services to Corporates,

Institutions & Government Organizations. The relationship management approach,

innovative product structuring and strong marketing and distributions capabilities

have propelled RR to be a Leading Domestic Investment Bank.

RR has a proactive relationship with major market participants Issuers and Investors:

expertise in product design and structuring: strong distribution reach – both

Wholesale and Retail: and focused research. RR’s Investment Banking business

today serves as an efficient link between a wide spectrum of Issuers and Investors.

Through close interaction, specific client requirements are related to the prevailing

market scenario to provide easy and flexible solutions in a dynamic and rapidly

changing environment.

RR has ranked the top firms in the private placement markets for

the last ten years. With a structured and focused sales force, RR’s standing

are the result of the focused investor relationship management approach created

with long term prospective of offering superior products and services. With an active

presence in almost all the major centers, RR offers a variety of products to investors.

RR offers advisory services to corporate for raising Debt, Equity,

Quasi Debt and other structured products. In addition it also offers advisory for

IPO, Rights Issues, QIP, M&A, Debt & Equity Placements, Infrastructure Financing,

Money Market Operations etc.

- Corporate Valuation

- Leveraged Buyouts

- Management Buy-out / Buy-ins

- Buy / Sell side transactions

- Identification of target, valuation, negotiating & tendering

panel offer

- Framing deal structures

- Assist in Due Diligence

- Joint Ventures:

- Evaluation of potential joint venture partners

- Assistance in negotiations

- Capital Structuring & fund raising

- Corporate Restructuring

- Capital Restructuring

- Generational changes of ownership

- Review of strategic alternatives

For More Information, Please mail us – rrinvestor@rrfcl.com

FINANCIAL SOLUTIONS

(1) RR deals with over 5,00,000 individual customers through 400

locations spread in 100 cities and have a field staff of over 10,000 agents.

(2) The company has 200 Corporate, over 1000 HNI’s and 5.00 lakh retails customers

and 10000 Agents with a Pan India Presence.

(3) The company deals through 3 distinct Sales Channels i.e. Wealth Management,

Retail Direct & Retail Network.

- Mutual Funds

- Fixed Deposits

- Initial Public Offerings

- Tax Saving Schemes

- Retail Bonds

- Wealth Management

(1) RR manages Rs. 2000 cr. Approx. Assets under Management, out

of which nearly Rs. 1300 cr. in Equity & Equity Related Products.

(2) RR has one of longest Assets Under Management with an average age of assets

in Mutual Funds of 414 days (source : CAMS).

(3) RR has 1.5-2% of market shares in New Fund Offers.

(4) RR has been consistently ranked among top 3 independent retails distributors

in the Country.

(5) RR has independent in house research team focused on qualitative analysis on

various schemes of Mutual Funds.

(6) RR is moving towards online transactions & building of platform for Fund

of Fund Model.

(1) RR is Lead Arranger for nearly 200 Companies Manufacturing,

Govt. /PSUs and NBFCs.

(2) RR is one of the few National Distributor with focused teams for mobilization

in Fixed Deposits and other Retail Fixed Income products.

(3) RR mobilizes Rs 250 Crores of deposits on a Monthly basis.

(4) RR deals with PF Trusts, Institution, Retail Clients through Branches and Associates.

RR has been the top Mobilizer and has been involved as Lead Arrangers for GOS /

PUS Bonds and State Govt. papers.

(5) RR is the only focused distributor that provides online portfolio even for Fixed

Income product along with renewal reminders of FD maturing.

(6) RR has been able to focus on Fixed Incomes as an alternate Asset Class against

Bank Deposits with the retail Investors.

RR Retail is supported by in house research providing unbiased

and Independent research with 10 full time Research Analysts.

- Stock Market Fundamental and Technical Analysis Money Market and

Debt Market Research

- Intra days Market Commentary and technical Analysis

- Mutual Fund Research

- Company and Industry Research

- Monthly Magazine ‘Investment Monitor’ which is sold

on stands.

For More Information, Please mail us – rrinvestor@rrfcl.com

INSURANCE BROKING

RR Insurance Brokers (RRIB) is promoted by RR Financial Consultants

Ltd, a leading financial & Insurance services company headquarters in Delhi.

- RRIB is a professionally managed company having a competent team

of Risk Managers, Engineers and Property and Casualty Insurance Experts.

- It has grown consistently and successfully during last six years

providing complete Risk Management and Insurance solutions to its clients

- RRIB covers all sectors of the Key Risk Management & Insurance

Products i.e., Life, Annuity, Health & Benefit, Property, Casualty and Liabilities

- Dedicated resources for RMIP ( Risk Management & Insurance Portfolio)

Analysis

- RRIB is a professionally managed company having a competent team

of Risk Managers, Engineers and Property and Casualty Insurance Experts.

- The company has issued over 100 policies per day in 2006 and currently

issues over 300 policies per day.

- Portfolio Analysis

- Risk Management

- Placement Services

- Claims Management

- Knowledge Sharing and Capability Building

- Thorough examination of existing policies

- Observations and findings- report on existing policies

- Identifying the PERILS & HAZARDS involved in the risk vis-à-vis

coverage

- Suitable recommendation on the basis of above GAP Analysis.

- Key recommendations with draft wordings for amendments Risk Management

- Site Risk Survey (SRS) – on site physical inspection of Risk

- Identifying the specific PERILS & HAZARDS of the Plant

- PML Analysis

- Activity Analysis

- HAZOP Analysis

- Identifying the Risk Management Strategy mix- absorb/transfer/avoid

- Implementation of Risk Management Strategy approved by client.

- Motor Insurance

- Health Insurance

- Travel Insurance

- Personal Accident Insurance

- Household Insurance

- TV Insurance

- Laptop all risk Insurance

- Shopkeeper Package Insurance

- Jewellers Block Insurance

- Office Package Insurance

- Baggage Insurance

- Workmen Compensation Insurance

- EEI Insurance for Internet shops

- Restaurants & Nursing Home package Insurance

- Machinery Breakdown Insurance for engg. Workshops

- Site Risk Survey (SRS) – on site physical inspection of Risk

- Rigorous and Comprehensive Insurance Programme Audits

- Identifying the risks to which our client’s Assets and Liabilities-Balance

Sheet is exposed

- Assessing the potential impact of risks on company’s operations

and finances

- Business Continuity Plan drafting assistance

- Implementation of Risk Management Strategy approved by client

- Presentation of Client Portfolio to underwriters along with detail

Risk Report

- Discussions with underwriters on terms offered and requirements

mismatch

- Confirming terms required from underwriters

- Comparative Analysis of Quotes and terms received

- SLA and Service Agreements draft consent from Underwriters

- Presentation to Client with recommendations

- Client, Insurer and Service Provider Meeting

- Placement of business

- Claims management starts from the time of issuance of policy

- It starts with ensuring dedicated surveyor panel is provided to

Client at time of issuance of policy

- Intimation of claims onwards we help client to complete documents

- Our technical staff is available at time of survey at client location

for smooth processing

- Negotiation of claims as per policy terms and conditions along with

client

- Timely settlement of ON ACCOUNT payments/FINAL settlements are ensured

by our claims team.

- Educating the client about the Risk Management Process in their

premises.

- Ensuring involvement of Board level executives of client in Risk

Management

- Designing Reporting Formats for insurance requirements e.g., claims

reporting, declaration of marine transits/ fire policy stock declarations etc.

- Helping prepare the claims documents.

- Developing awareness of claims Process amongst concerned departments

of client Organization

- Designing Insurance Procedural Manual as per Client requirements.

- Help our clients get their endorsements effected on time

- Help file claims and complete documents for early settlement claims

- Health Insurance- guiding and helping fulfill requirements relating

to health checkup for higher age band customers

- Provide cash less list and arrange cash less at non-network hospitals

in consultation with Insurers

- Help clients take benefit of free health check ups as per policy

terms.

- Valuation of Jewellery for insurance purposes guidance and help.

- We have more than 35000 happy clients in motor insurance

- We have provided peace of mind to more than 12000 customers by providing

them Health cover

- We have proven our service and support to our clients in time of

claims more than 2000 times during 2008-09

- We reached to more than 50000 individual buyer of insurance through

our team of employees and telecalling support team.

- Dedicated telecaller services for guiding claims process

- Liaison with insurers for timely settlement of claims

- We have proven our service and support to our clients in times of

claims – more than 2000 times during 2008-09

- Periodic Reporting from Insurer on claims

For More Information, Please mail us – rrib@rrfcl.com

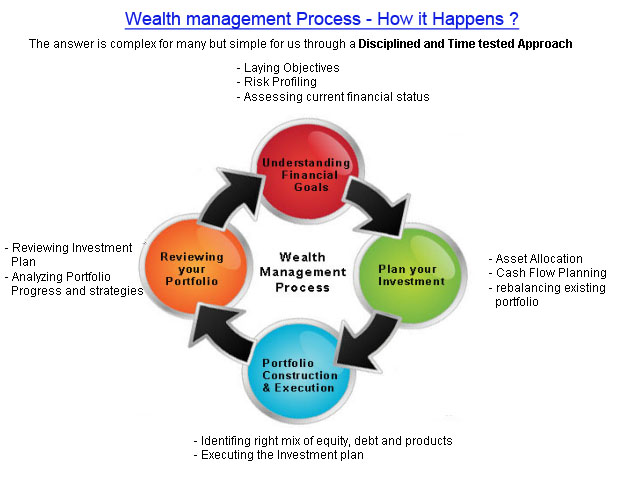

WEALTH MANAGMENT

Wealth is the result of a recognized opportunity. At

, we understand

this and work with you to plan and manage financial opportunities prudently, which

leads to wealth creation.

An exclusive initiative, provides you the much-needed thrust required

to set another milestone. Not just that RR relieves you of the worry of managing your finances whilst you

take care of your other important tasks.

As a diligent and well- experienced wealth management expert; we will collaborate

and guide you to realize your objective of wealth protection, creation and growth

through our dynamic approach. An approach, which is symbolic of the philosophy of

diligence and forward thinking, and strives to be constantly alert to changing market

environment with .

:

Our Wealth Management Process starts with understanding you –

your background, investment objectives, risk tolerance and existing investment style.

A Comprehensive Client Profiling exercise helps us in evaluating your risk appetite

and understanding your current financial status, which act as a base for building

a sound portfolio.

Based on your financial goal, wealth requirements, time horizon

and risk tolerance, we construct a suitable asset allocation plan for you. In this

exercise, we also quantify your goals and draw out a future cash flow to understand

how your money will move during various periods. We evaluate and re balance your

existing investments as per the suggested asset allocation, in case required by

you.

Once we make an optimal asset allocation mix, choose the mix of

financial products from a wide range of investment avenues and evolve with a tailor-made

portfolio as per your plan. Thereafter, it is execution of investments in debt,

equity, structured products or alternative asset classes.

To ensure you are on track we constantly monitor your investments

and periodically suggest rebalancing your portfolio for maintaining the asset allocation

or aligning your portfolio to changes in macro economic factors that might affect

your investments. We also review your investment preferences or financial goals,

which may change over a period and accordingly tweak the investment plan to accommodate

the changes.

- Access to a dedicated Wealth Manager who would be one contact

point for all your needs

A well documented financial and investment plan would be given to you which would

drawn on the basis of your current financial and future

- Real-Time On line Portfolio Tracker - Gives you one consolidated

report of the current holding value of all your investments

- Monthly/Quarterly Portfolio Reviews by RR Advisory Experts, who

would guide you for any actions that need to be taken on your portfolio

- Fortnightly Portfolio Updates through physical hard copies.

- Daily Market Reports across various asset classes equity, debt,

agri-commodity, gold and currency

- Event Specific Reports

- Stock and Sector Specific Reports

- Access to MF Online Transaction Platform, which makes mutual fund

investing seamless.

-

– A monthly market based publication by RR Research team.

For More Information, Please

mail us – wealth@rrfcl.com

- Equity

- Commodity

- Depository

- Forex

- Interest Rate Futures

|